- Solution overview

Want to pitch a perfect game?

Cora LiveWealth helps you shutout the competition

Too much paper, not enough time

Wealth management companies worldwide face real challenges if they don’t have the right technology to aggregate, extract, and process data from electronic and paper fund management statements. They’re forced to fall back on entering all that by hand. The result? Mistakes in billing and in customer assets reporting. And that means financial advisors spend far too much time covering for system and process gaps. Just imagine what they could do if they focused their efforts on value-added analysis and engaging with the customer instead.

AI for wealth and asset management

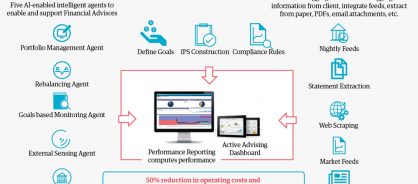

Genpact Cora LiveWealth transforms the financial advisor and client experience. Its patented extraction technology not only sources information for reporting, it intelligently automates the end-to-end reporting process. What’s more, this flexible solution is always live. It can be modified on the fly—rapidly—without any maintenance overhead. Here’s what it does and how it works.

Figure 1 : Cora LiveWealth

Management firms can drive better client experiences with Cora LiveWealth. And they can do so economically and rapidly, without disrupting their existing IT infrastructure.

Cora LiveWealth’s features include:

MULTI-CUSTODIAN AGGREGATION:

LiveWealth’s aggregation engine amasses data from all US and most major international custodians. It automatically extracts data from financial statements and creates a normalized view—all with 100% accuracy.

ROBUST PERFORMANCE AND RISK ANALYTICS:

A portfolio analytics engine provides industry-standard performance reporting models. The solution also builds models customized for every client and offers a rich pallet of other analytical tools. Among its great features: ex-post and ex-ante performance modeling, multi-asset classification, benchmark comparisons, and portfolioand security-level analyses.

INVESTOR POLICY STATEMENT CONSTRUCTION AND MONITORING:

Cora LiveWealth monitors how people apply investment policies to make sure they stick to protocol. It has a comprehensive audit trail, an easy-to-use questionnaire, automated document generation, and regulatory compliance reporting.

NON-INTRUSIVE AUTOMATION:

Cora LiveWealth slips easily, flexibly, and quickly into a firm’s existing technology and process environment.

AUTONOMOUS AND ASSISTED BUILT-IN MACHINE LEARNING:

Cora LiveWealth extracts information from documents, normalizes the extracted data using the template of your choice, then analyzes the normalized data.

Figure 2 : Multi-custodian aggregation

Key advantages include:

- Reduced operating costs

- Happy customers who get same-day or near-realtime asset analytics

- More consistent performance analyses

- Improved regulatory compliance and continuous risk assessment

Figure 3 : Non-intrusive automation

Why Genpact?

For Fortune 1000 enterprises looking to drive digital transformation, Genpact AI delivers a distinct competitive advantage. Unlike other service providers, Genpact AI integrates our deep domain knowledge with leading AI technology and services to enable significant business value creation and accelerate the success of our clients’ digital transformations.

Success story

To keep demanding customers satisfied, one global wealth management firm knew it had to act. It wanted to give clients analyses and asset reports in real time, but fragmented data collection and tracking processes made that impossible. Enter Genpact. In just 90 days, Genpact’s Cora LiveWealth product helped the company transform its master data management process into a well-oiled machine. The upshot: Improved efficiency, faster turnaround time, happy clients, and overall growth.