- Solution overview

Claims Triage: segmentation and analytics claim scoring

Slick FNOL analytics and processes to speed up the claims cycle

At present, property and auto personal lines insurers spend up to 40% of the claims cycle time manually assigning and re-assigning the claim - assessing the complexity, identifying suitable adjusters and recommending next steps. What a waste of your, and your customers’, time.

Our analytics claim scoring solutions can make the overall FNOL process, including claims triage, lightning fast. Broader data sources are bought into play to make quicker, more accurate decisions about whether the claim can be fast-tracked, and who the claim should be allocated to. Low complexity claims can speed their way through the system and more complicated claims allocated to a specialized loss adjuster.

How does it work?

Our approach combines our years of expertise in claims management with state of the art machine learning. An AI model embedded within the claims workflow to deliver real-time complexity scoring and the automated allocation of claims based on loss adjuster availability and specialization

- We introduce omni-channel FNOL intake

- We leverage data from multiple sources (internal and external, structured and unstructured) at FNOL

- Claims are assigned a complexity score leveraging our Genpact Cora Analytics platform recognizes development patterns of similar nature historical claims multiple parameters namely severity, cycle time, litigation & subrogation potential, degree of suspiciousness, bodily injury and physical damage extent

- Claims are segmented and routed to the right team and adjuster based on these complexity scores and adjuster skill-set as well as workload

- Low complexity claims are routed for straight through payments

- Our workflow management integrates FNOL systems, document management, and adjuster allocation systems to settle claims quicker and improve the visibility of claim status

Take a copy for yourself

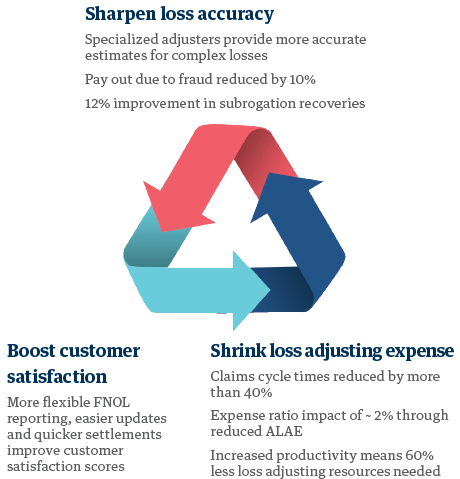

It's a win-win for customers and insurers

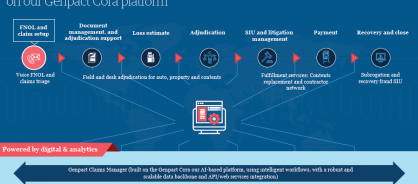

Our end-to-end smart claims approach consists of modular offering built on our Genpact Cora platform

Genpact and claims

Ever-increasing auto and natural catastrophe claims. Rising customer service demands. Aging legacy systems. These are just some of the challenges insurers face that digital technologies like automation, AI, and analytics can help tackle. Our digital tools optimize the balance between customer satisfaction, accurate loss assessment, and loss adjusting expenses. They span the claims journey, handling everything from fast-track claims processing to fraud and subrogation analytics. You can start with the module that addresses your biggest challenge and add from there. Or we can run your entire claims operation.

Global insurers and reinsurers, surplus lines insurers, a European insurer, even a top-10 Fortune company – we've transformed claims for them all over the past 15 years. We combine the digital understanding of an insurtech with claims expertise and business process know-how. Let's put this to work for you.