Creating shining success

A story of reinventing collections to deliver better experiences at GE Lighting, a Savant company

It all starts with a spark

With roots tracing back to Thomas Edison, GE Lighting, a Savant Company, has spent over 130 years at the forefront of lighting technology. By developing technologies that support lower energy consumption in smart connected homes, it creates bright, healthy lives in a sustainable world.

Savant acquired GE Lighting in July 2020, kickstarting a radical change in its finance function. Led by Roy Simmons, a CFO with vision, it collaborated with Genpact on an ambitious digital transformation project. Sparking a reinvention of the role of financial insight in the business, the partnership enables Savant to forge better relationships with its retail customers. In turn, this helps its customers to deliver better service to end consumers. All this change started in accounts receivable and collections.

This is how we did it.

The challenge

The cost of uncertainty

When Savant acquired GE Lighting in July 2020, it was left with just six months to separate its finance strategy from its former parent company. Retail partner deductions weren't always accurate, and the company had to provide greater visibility for billings and collections covering approximately $100 million of activity.

There were other obstacles to overcome. An ERP migration created a backlog of nearly 16,000 line items for the accounts receivable team. This meant that nearly a quarter of receivables from major retailers were past due.

Delays in payment from customers were once cushioned by the scale of the parent organization. But that cushion would soon go. Would it be enough simply to tighten existing collections processes? To fix gaps before achieving financial independence from GE?

Not for Roy Simmons and the Savant finance team.

Searching for clarity

Savant needed a big transformation to bring more clarity to its billing process and give customers the transparency they craved. With any large change project though, there are often core hurdles to overcome.

Viewing business functions as purely operational

This happens right across the C-suite in many companies. Functions are often treated in isolation with a short-term operational view. For finance, people think it's only about balancing the books. The teams at Genpact and Savant wanted to elevate the role of finance: to make it a strategic partner, not just another department.

Continuing to use ineffective legacy systems

A pressured environment can make companies reluctant to rethink outdated legacy systems. Especially when it impacts relationships with external stakeholders. One of the main goals of this digital overhaul for Roy and team was to improve relationships between Savant and its customers.

Enhancing the team's skills

Teams that rely mainly on manual processes often have a skills gap when it comes to implementing successful digital transformation. Change needs to be managed properly and staff upskilled to prevent disruptions.

The solution

Foundations for change

The acquisition offered the chance to create a strategic function that was central to company growth. To achieve this reimagined world, digital technology would be the enabler. Shaping the right transformation partnership and approach was therefore essential. Savant and Genpact formed a dedicated project team sponsored by senior executives on both sides.

Through close collaboration, the team implemented a roadmap for transformation. With this long-term approach, Savant could operate effectively within the uncertainty of modern markets and environments – an essential for all businesses today.

"Roy is always open to new ideas. When you pitch something to him he'll say just go and do it, no questions asked. It sets him apart. And it's this flexibility and willingness to change that has driven such a successful digital transformation. That and his personal touch when getting the best out of every member of the team."

Surajit Pal, Client Partner, Genpact

Let's get visible

When the team saw opportunity shine bright, they reached deep into the digital toolbox. Using process mapping and diagnostics to help transform invoice to cash, performing value-stream mapping through a Lean Six Sigma framework, and delivering time-driven project management, they were able to:

Improve decision-making

Accessing quality finance insights quickly is essential. AI-driven predictive analytics helped Savant understand payment patterns and make more effective decisions on collections processes.

Enhance customer experience

Improving the visibility of payment and billing schedules and simplifying processes meant more engaged customers and the ability to plan for the growth of their businesses. This ensured more products on shop shelves and in homes, with more people realizing the benefits of lighting in connected home systems.

Boost efficiency

Using automation to make billings and collections smoother and more efficient helped Savant to recover millions of dollars of what would otherwise be missing revenue.

The transformation

Transformation begins with information

The roadmap that the team created focused on three key questions, centered on the needs of Savant's employees and customers. Their answers delivered the basis for the company's transformation:

1. How can finance use collections data for strategic decision making? Savant had the data, but the question was how to use it. By looking into historic deductions data and using predictive analytics, the team created a range of scenarios for improving invalid deduction recovery. Now, the team can identify accurate customer payment patterns and implement bespoke collection strategies.

2. How can Savant better serve its customers?

- Create the skills to succeed: Together, we identified areas where the finance team required upskilling. It needed new levels of collaboration between groups to manage disputes and collection.

- Streamline ways of working: Under the old system, a centralized finance team managed the dispute and collections process. Now, the account teams own these relationships with support from the central team, defining the process and assigning team members to oversee portfolios. Team members can now engage customers faster, without creating overlap. This ensures a lighter, more human touch while enabling faster engagement.

- Give employees the insights they need to work smarter: The centralized team can now concentrate on providing essential insight to account teams. Predictive analytics detail which customers are at risk of late payment, enabling account teams to focus on problem areas. The result? Faster collections, further boosting the morale of account teams incentivized to drive outcomes.

3. How can Savant ease the transition for customers?

With any transformation project, it's vital to get stakeholders from outside the business on board too. Savant increased visibility for its retailers and distributors through timely, accurate, and up-to-date reporting on all billings and collections. Alongside this, it created a robust follow-up mechanism to engage customers in quicker recoveries or, if necessary, to facilitate recovery negotiations.

The impact

A role reinvented

Savant's finance function transcended the need to become self-sustaining. It transformed visibility in collections to change how people work.

Today, it continues to add strategic value to the business as a whole. If you want to dothe same, here are some key takeaways:

Look past quick fixes

For Roy and his team, it was fundamental to completely reinvent legacy systems and existing ways of working – earning the finance team a strategic seat at the table.

Gain payment insight from customer behavior

By using algorithms to better understand how customers behave regarding past-due invoices and risk, Savant can predict their potential stability and credit-worthiness – even estimating when payments might be late.

Forge stronger relationships with customers

With end-to-end visibility of all payments and collections, Savant's customers also enjoy greater operational simplicity. Savant now has customized processes that understand its customers' needs and languages. Crucially, they can quickly and easily manage payments, deductions, and returns. They know exactly where they are in the payments process whenever they deal with Savant. With clearer processes and visibility, Savant has built greater trust among its customers, trust that has resulted in customers giving Savant more of their business.

Build productive teams with targeted strategies

The account teams know when to engage customers about payments and collections. And if they know that customers will pay even if they're going to be late, there's no need to chase. This is a streamlined and effective process for collections. One that keeps internal morale high.

Make confident cash-flow predictions

Financial forecasting is notoriously complex. But Savant has dramatically improved its ability to predict and manage its cash flow. It has developed a comprehensive set of best practices to maintain the accelerated pace of cash flow in the future. Enhanced processes for monitoring deductions and entitlements provide the insight to continuously refine recovery strategies and prevent invalid deductions.

"Thanks to Savant's transformation program, we're confident that customers will get paid on time and open customer claims will be cleared in a timely manner. Their billing is simpler, saving them time and effort, and allowing us to deliver a better overall experience."

Andy Sharp, Category Manager, Langenfeld

Key stats

A spotlight on results

Savant's reimagined finance function has brought continuous benefits to its customers and their end consumers. The internal finance team is more valued than ever and the future of the business looks remarkably bright.

Timely and accurate reporting helped Savant to:

- Cut past-due accounts receivable by 75%

- Reduce disputed accounts receivable by 50%

- Achieve best-in-class unapplied cash of 1% of accounts receivable

- Recover $3.8 million of deductions in 2.5 years

- Predict customers' stability and credit-worthiness

- Make internal processes more streamlined and productive

- Improve its ability to predict and manage cash flow

- Strengthen relationships with customers

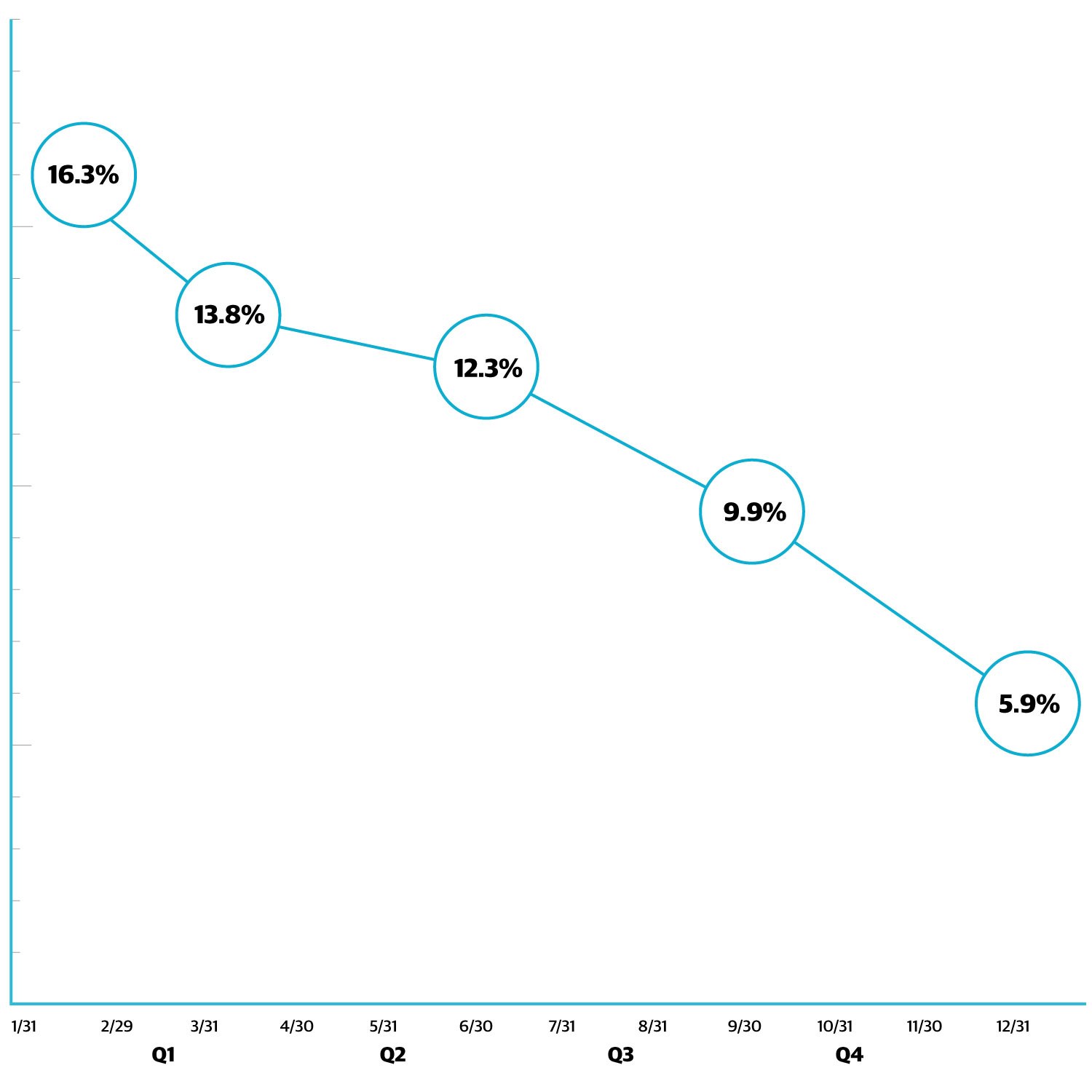

Net past-due % reduction from 16.3% to 5.9% in 12 months

Long-term vision

Now it's your time to shine

For the finance team, avoiding quick fixes and being purpose-led has delivered a world that works better for its customers, people, and the company.

Forget the perceived difficulties in reinventing legacy systems. Think of opportunity. Question what real transformation can do for your business and your customer relationships.

This was Savant and Genpact's approach. By focusing on adding strategic value, we reinvented the role of finance and the CFO. And by helping to get more products on the shelves, the partnership is delivering on Savant's commitment to building a sustainable world through products that make lives easier and safer, while making homes more energy efficient. Up next for Savant's finance team? Planning for the next 130 years.

Build resilience, mitigate risk, and fuel innovation

Discover more about digital transformation for finance and Genpact's unique approach.