- Technical paper

COVID-19: Impact and recommendations for credit risk management

The COVID-19 pandemic has posed far reaching consequences in the US and around the world. In a world now starkly divided into pre- and post-COVID times, it's imperative to examine the impact of this public health crisis on businesses and societies.

With the increasing health and human tolls and restriction on people's mobility, the pandemic has stalled the economic engine worldwide. The repercussions of this are not limited to any one industry. The banking and financial services sector is also facing severe challenges, perhaps its biggest in many decades.

The objective of this paper is to outline the challenges posed by the pandemic and present proposals for concrete actions through which banks can identify, manage, and mitigate credit risk during these times. This paper focuses on data and analytics interventions to mitigate potential challenges.

The recommended interventions have been outlined across customer credit lifecycle and banks' regulatory obligations on stress testing and reserving, and includes diagnostics and analytics, enhanced reporting and monitoring, and model adjustments. The key consideration is to keep the implementation cycle time short and iterative in nature to learn from the response and make necessary adjustments as the crisis evolves.

COVID-19 is adversely impacting banks' credit portfolios

As the current economic crisis unfolds against the backdrop of a public health emergency, the unprecedented rise in unemployment and disruption in economic activity is putting a strain on the solvency of customers and companies. A larger number of distressed customers are seeking help for financial hardships across consumer and commercial lending portfolios. Highlighted below are some statistics that demonstrate the severity of impact on consumers.

- Mortgage forbearance increased sharply showing nearly 3,000% increase from March 2020 to May 2020

- Auto loan modification requests increased nearly 10 times across the industry since the pandemic began

- Inquiries for credit cards, new mortgages, and auto loans dropped by 30–50% compared to the same time last year

To prepare for such extreme shocks and uncertainty, large US banks have increased their loss provisions by ~3–4 times for Q1 2020 as compared to Q4 2019, based on their expectations of impending defaults and charge-offs.

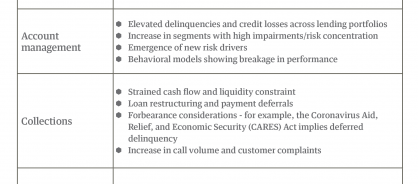

The table below elaborates on the impact of COVID-19 on customer credit lifecycle, reserving, and capital estimation.

Table 1: Impact areas and implications on retail and commercial lending portfolios

When the economic environment shifts as quickly as it has in this crisis, the government, regulators and financial institutions need to employ a slew of actions to manage and mitigate credit risk (see a summary of government and regulators’ actions in the Appendix).

Proposal for banks' credit risk management interventions

Banks have provided customers with relief measures such as payment deferrals, mortgage forbearance, loan modifications, late fee waivers, and suspension in reporting account delinquencies.

Such interventions, while necessary to provide temporary relief to customers, must also be accompanied by enhanced risk management actions across impact areas:

A. Acquisition

B. Account management

C. Collections

D. Reserving and Capital Planning

The actions can be divided into three broad pillars of intervention across the credit lifecycle:

- Diagnostics and analytics

- Enhanced reporting and monitoring

- Model adjustments

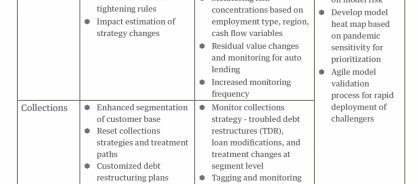

Table 2: Recommendations for credit risk management interventions

A. Reset acquisition strategies with tightening of cutoffs, limit adjustments, and expanded use of traditional and alternative data

The current crisis calls for review of the existing acquisition policies, strategies, and cutoffs to manage emerging risks and provide ongoing credit to customers. The actions by banks during these times will inspire future costumer loyalties, help gain market share, and mitigate reputational risk.

Optimize attribute cutoffs:

Origination cutoffs should be adjusted to ensure acceptable levels of risk from new originations.

- What-if scenario analyses to revise origination score/attribute cutoffs based on risk-return trade-off, aimed at controlling losses while ensuring acceptable approval rate

- Reduce initial credit limit assignment (for revolving line of credit)

Additional attributes can be used to tighten the strategy along with stricter employment and income verification.

Refine segmentation:

Create granular risk tiers for origination and monitoring through:

- Expanded use of traditional (credit bureau and internal attributes) and/or alternative data to identify pockets where new originations would still be viable based on the risk-reward balance

- Monitor and report on new volumes at segment level based on revised acquisition strategies

- Focused monitoring by region, considering the transmission rate and response to relaxed public movement restrictions. Mobility and transmission indices such as the Google mobility index or Rt index, which captures the R-naught of transmission by region are also useful

Data Enrichment:

- Risk scores along with additional data attributes such as payments, debt-to-income ratio, net cash flow variables, and so forth can improve targeting

- Cash flow variables derived from customer-level income and expenses are forward-looking and better predictors of ability to pay in a crisis

- Alternative data from utilities, rental payments, public records, and alternative lending like payday, rent-to-own, small-dollar loans, and so on can better identify pockets with a lack of willingness and/or ability to pay

- Traditional delinquency bureau variables and their derivatives, which are typically used in acquisition, should be used with caution because they may be tainted by the payment deferrals, forbearance, and loan modification programs

Monitoring for early warning signals and corrective actions:

Shorter-term performance window models can be used to trigger early warning signals on the new volume and existing book to exercise early lifecycle controls.

Iterative evaluation:

The above should be coupled with a comprehensive and semi-automated what-if scenario analysis framework to estimate the P&L impact of strategy changes in alternative scenarios, which would help iteratively fine-tune acquisition strategies based on risk appetite and portfolio growth considerations. The loss expectations in the P&L impact can be derived by repurposing banks' existing forward-looking stress-test models.

Overall, acquisition strategies should be guided by what-if analyses, sensitivity testing, and the portfolio risk appetite. It would require iterative fine-tuning in an agile framework to counter emerging risks and increase the risk-adjusted margins and profitability.

Banks should also ensure a reasonable oversight and governance from the model risk function when new attributes are being used in acquisition decisions. Legal and compliance counsel should also be kept in the loop on evolving acquisition strategies to ensure that they comply with fair lending practices.

Case Study 1: A large US consumer bank

Genpact supported enhancement of a suite of customer acquisition strategies for the bank as a tightening measure in the COVID-19 situation. This includes adjusting auto-decision rules to reduce referral queueing and wait time, resetting customer credit limits for new and existing accounts, and adjusting approval thresholds for new applications. Segmentation, scenario, and iterative what-if analyses are being performed to come up with quick and easy-to-implement recommendations.

Overall, acquisition strategies should be guided by what-if analyses, sensitivity testing, and the portfolio risk appetite. It would require iterative fine-tuning in an agile framework to counter emerging risks and increase the risk-adjusted margins and profitability.

Banks should also ensure a reasonable oversight and governance from the model risk function when new attributes are being used in acquisition decisions. Legal and compliance counsel should also be kept in the loop on evolving acquisition strategies to ensure that they comply with fair lending practices.

Visit our credit risk management page

B. Refresh account management strategies with tighter monitoring, line optimization, and account treatment

In the evolving crisis, risk managers should proactively engage in account management to continually monitor high-risk concentrations in their portfolios and effectively mitigate risk. Managing revolving-line-of-credit products becomes especially relevant in this regard because there are several levers to mitigate risk in such portfolios.

Enhanced monitoring and reporting:

More frequent risk monitoring (daily/weekly) with additional KPIs would be required to augment the business as usual risk reporting in most banks. These KPIs may include but not be limited to revolver utilization trends, credit line trends, active versus inactive account trends, COVID-19 call volumes, payment deferral requests, loss mitigation trends, and so forth. Such enhanced reporting can be categorized by products and into finer customer and geographic segments, especially taking into account the transmission in a region. This will help banks identify segments that are contributing to a disproportionate share of losses and guide strategy-tightening measures.

Credit line optimization:

- Prompt line-decrease actions for high-risk pockets based on early warning signals, aimed at reducing future “bad spend" through targeted actions

- Increase cutoffs for line increases based on revised risk identification and tiering

- Reoptimize increase amounts and frequency

Inactive account treatment:

Inactive account line reduction and closure strategies also need to be reevaluated to reduce exposure and limit potential losses. During a crisis, inactive accounts also tend to draw and default as other sources of debt are restricted.

Risk management in a new/young portfolio:

The account management of a young portfolio poses additional challenges for banks because they may see an increase in early delinquency and payment deferral requests during the pandemic, and there is not enough performance history in such portfolios to make informed data-driven decisions. Young portfolios carry the risk of adverse selection, especially with new product launches. Risk managers should creatively use bureau and alternative data sources to address this issue. Data enrichment strategy for account management can include:

- Use of underutilized attributes like debt-to-income ratio, total debt, recent inquiries, payment variables, employment types, and so forth

- Use of shorter-term performances like utilization and payments on active revolving trade in the past three months for early warning triggers

- Use of debt-related derogatory public records to supplement tradeline data

- Use of alternative lending payment information and financial payment information from utilities, telecom, property records, and so on to enrich traditional data streams

Credit bureau data, however, must be used with caution during the current crisis given the tainted delinquency, charge-off, and loan modification variables. This is especially true given the varying treatment by banks to support customers in financial stress through forbearance and payment deferrals.

The underlying success factor for effective account management is to identify customers facing temporary economic hardship as compared to the ones facing structural impairment in their ability to pay. Such differentiation can be achieved using additional attributes like the debt to income ratio, payment velocity index, and/or by creating ability to pay scores from alternative and unstructured data collected from COVID-19 calls and payment deferral requests.

Case Study 2: A leading US bank

We developed easy-to-consume trend and comparative portfolio analysis dashboards leveraging account-level data of ~90 of the bank's portfolios. Key metrics focused on exposure, utilization, delinquency roll rates, and loss mitigation program enrollments including potential KPI impact because of the CARES Act. Leveraging big data platforms and cloud-based business intelligence tools, web-browser based reports are being built for risk managers and leadership reviews.

C. Reassess collection strategies with a focus on enhanced monitoring, updated segmentation, and treatment optimization

The collection and recovery function sometimes takes a back seat in an expanding economic environment because wage growth and decreasing unemployment put more focus on growth and new originations. Given that the last recession was more structural in nature and required enhancement in approaches for capital stress testing and reserving, collections in the banking space did not evolve as much as it should have in advanced analytics and technology adoption. The current crisis has returned the spotlight to this area. Data analytics, including monitoring, strategy, and model enhancements can drive informed collection actions during these times.

The level of forbearance and loan extension requests seen in the industry has been unprecedented in this crisis. With its economic package, the government has provided temporary relief to customers and deferred the impact on rising delinquency and loss realization. There is no straightforward approach to measuring the impact of government relief programs on charge-offs. It would thus be critical for banks to monitor early delinquencies, use finer segmentation to identify emerging high-risk concentration, and apply treatment that would maximize collection dollars.

Monitoring:

The population impacted by COVID-19 and deferrals/extensions provided through government or bank relief programs need to be tagged and updated in the data on an ongoing basis. Granular performance monitoring by region, risk bands, employment type, and so on would be required to understand high-risk concentrations and identify early warning signals. These signals can also be generated using an expanded set of bureau variables as well as internal and alternative data attributes. Some of these attributes have been referenced as data enrichment in the acquisition strategy section of this paper.

Updated segmentation and collections strategies:

Early warning signals at a granular level should inform collections strategies as the impact of the pandemic evolves.

- Pre-delinquent actions: Identify pre-delinquent segments that are likely to move to delinquency and use digital channels for payment reminders. The population on deferment plans needs close monitoring and assessment, including potential extension of relief term if there is a possibility for repayment when the situation improves. On the other hand, if the customer was already displaying financial difficulties, focused recovery efforts would be required instead of delaying further

- Self-cure: Self-cure segment identification on early delinquent accounts is important to limit resource diversion, increase collectors' capacity, and prioritize collection resources on accounts that need agent contact and offers. Bureau data and alternative data in machine learning models can fine-tune collections strategies to identify accounts that require no intervention to softer automated interventions on their path to self-cure

- Late stage delinquencies: Late-stage collection analytics and modeling is required to identify segments of customers who are more likely to pay based on their ability-to-pay and willing-to-pay scores. Such analytics can use machine-learning-based approaches to predict payment projections and estimate the value at risk for each customer. This can then be paired with customer response models for various contact strategies and offers

Treatment:

Treatment optimization and response to treatment is another key area of collection analytics that should leverage both structured and unstructured data to maximize recovery and minimize cost. As more granular segmentation is developed to better understand evolving customer behavior and emerging risks, treatment strategies should be personalized at a micro-segment level.

The key objective here is to arrive at the best treatment based on customer probability of response and banks' need for minimizing charge-offs and cost. This can often turn out to be a nonlinear optimization problem with several constraints.

Enhanced monitoring, granular segmentation, and personalized dynamic treatment optimization are essential for dealing with the challenges posed by the pandemic and the evolving situation. Further, banks can explore expanded use of internal, bureau, and alternative data to refine collection strategies in the COVID-19 situation.

Case Study 3: A global auto finance leader

We set up comprehensive reporting for accounts on payment extension/deferral as part of the relief program. We also segmented the account base by region and portfolio/bureau performance to identify high-risk pockets that may turn delinquent at the end of the deferral period. Then, developed proactive collection strategies for pre-delinquent and early delinquent accounts using finer segmentation and customer behavior scorecards.

Visit our digital transformation page

D. Need for agility in the reserving and capital estimation process with focus on model adjustments and overlays

Reserving and capital estimation, while not part of the customer credit lifecycle, is critical to the financial health of a banking institution. The current crisis puts added focus on these activities as the regulatory programs of comprehensive capital analysis and review (CCAR), current expected credit losses (CECL) and the international financial reporting standard 9 (IFRS 9) were designed to make the banking and financial services organizations resilient in the face of emerging economic crises. Like every crisis, the current pandemic has also humbled quants and risk managers as they find model-driven expected credit loss forecasts to be at unprecedented levels, given the magnitude and speed at which the macroeconomic situation has deteriorated.

Supervisory agencies have recognized the implication of the crisis on banks and its customers and provided concessions in the spirit of keeping day-to-day operations running. Relief has been provided by way of relaxation of timelines for regulatory reporting, regulatory examination timelines, CECL adoption, and adjustment of the supervisory approach for aspects of loan modification, among others.

Though the above relief measures are timely and have been well received by banks, the current crisis has created a need for agility, quick turnaround, and automated calculation of expected credit losses under various economic scenarios. Given that model predictions by most of the banks are falling outside reasonable range, there is a need to come up with a structure for estimating overlays and management adjustments that are stable quarter-over-quarter, in line with the industry response and not overly conservative or benign.

Banks can create a menu of scenario and adjustment approaches and choose those that work best for their customer profile and risk concentrations. These approaches can vary in complexity and granularity based on richness of data, existing modeling methodology, and portfolio size. A list of methods that can be evaluated to adjust expected credit loss models appears below.

Output adjustment:

- Absolute capping and flooring of predicted rates based on a historical maximum and minimum, along with applying +/- two standard deviation sensitivity. Data from the last financial crisis and/or data capturing the impact of hurricanes Harvey and Irma, if available and applicable with the geographic footprint, can be used for estimating the historical maximum and minimum

- Capping and flooring based on the rate of change quarter-over-quarter in the current prediction vis-à-vis historical experience

Input adjustment:

- Use of regional macro-economic variables as opposed to national indices in the models. Use of smoothing transformations and binned macro-economic variables to estimate adjustment

- In-house macro-economic scenario generation based on the regional footprint, mobility index, and transmission rate

- Identify double counting in loan level attributes and existing top-level adjustments in the models

- Bake in business expectation on the severity of rating downgrade, additional draws, and its impact on the expected credit losses

Given the increased frequency of model adjustments and overlays to these Tier – 1 models, there is a need for the model risk management (MRM) function to provide an effective challenge through a timely review of the adjustments made by the first line of defense. Immediate interventions from model risk can be summarized by the following steps:

- Model inventory heat map based on risk rating and risk tier to prioritize MRM efforts for oversight

- Assessment of overlays based on the methodology used as well as magnitude, stability, and sensitivity over time

- Evaluation of ongoing performance monitoring for breaches and root cause analysis

- Benchmarking results with industry numbers for reserves, capital, and default rates to assess the magnitude and directionality of the adjustment

In a nutshell, the need of the hour is to develop the capability of rapid forecasting, with implementation runs based on various external and internally developed scenarios and sensitivities in the portfolio. This, accompanied by a well-documented and thought-through attributional analysis that explains quarter-over-quarter change in loss forecast, would bring confidence in reporting not only to the regulators and auditors, but also to the street.

Case Study 4: A US CCAR SR 15-19 Bank

We provided end-to-end support for the COVID-19-related impact assessment and overlay estimation for the bank. We analyzed the sensitivity of IFRS 9 and CECL reserves to Moody’s provided and internally designed scenarios. We also performed reserve impact comparison and driver identification analysis under COVID-19 versus business as usual scenarios for IFRS9 and CECL. Finally, we consolidated the impacts of uncertainty driven by macroeconomic scenarios, rating downgrades and additional draws, and estimated additional reserves required across portfolios.

Conclusion

The COVID-19 pandemic has created great uncertainty regarding the future of the economy, and its scale of impact will depend on the intensity and duration of the underlying public health crisis. While the government and supervisory agencies are providing support and relief, banks need to rise to the occasion and proactively implement best practices in credit risk management to navigate through these times. These interventions must be thought through the stages of credit lifecycle to keep them dynamic and interconnected in nature based on the evolving risk landscape.

The banking organizations that respond to today's challenges with speed and flexibility, while keeping in mind customer needs during these unforeseen times, are the ones that would be top-of mind for customers as they think of their credit needs in the future.

Equally, keeping an eye on the medium- and long-term capability enhancements necessary to best serve customers in the post pandemic world is imperative.

Authors

Rafic Fahs

Senior Advisor, Risk and Compliance Advisory Council

Former Chief Model Risk Officer, Santander US

Jyotiska Mitra

Head, Banking and Capital Markets, Advanced Analytics

Mohammad Amir Sarosh

AVP, Banking and Capital Markets, Advanced Analytics

Appendix

Government actions to mitigate the impact of the economic crisis

The US congress has responded to the resulting economic hardship by passing the CARES Act, the largest ever peacetime stimulus package, which includes:

- Disaster relief for state and local governments

- Direct funding to hospitals along with assistance for doctors and nurses, and for stockpiling of medical supplies

- Financial assistance to distressed and struggling businesses

- Small business loans through its payment protection program

- Direct payment to and unemployment benefits for most Americans

Regulatory response to provide relief for banks and support to the market

Supervisory agencies like the Federal Reserve Board (FRB), the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, and the Consumer Financial Protection Bureau have also recognized the impact of the crisis on banks and its customers and provided concessions in the spirit of keeping core day-to-day operations running. The key relief measures include:

Relaxation in timelines

- Additional time for adoption of the CECL framework and extension of regulatory capital transition

- Extended deadlines for various regulatory report submissions like call report, FR Y-9C, and FR Y-11

- A 90-day extension for remediating the existing supervisory findings

Relaxation in supervisory activities

- The FRB ceased its examination activity for financial institutions with less than $100 billion in assets

- Delayed examination activities for financial institutions with more than $100 billion in assets

- Loan modifications related to COVID-19 are not to be categorized as troubled debt restructures (TDRs)

The FRB has also taken several steps to support liquidity and credit generation through actions such as lowering the interest rate, purchasing government and government-sponsored enterprise securities, and re-establishing programs on liquidity and credit support from the last financial crisis.