- Case study

Banking on robotics

A large US regional bank meets Bank Secrecy Act requirements with robotic process automation

Who we worked with

A major US financial services company offering banking, investments, and insurance services.

How we helped

We deployed robotic process automation (RPA) to generate capacity, improve compliance, and eliminate errors.

What the company needed

Reduced backlog, increased productivity, minimized number of errors, and optimized anti-money laundering processes for due diligence on prospects, clients for periodic review, and subjects of suspicious activity monitoring.

What the company got

Over the next five years, significant increase in time for investigators to focus on higher-value tasks, boosted regulatory compliance, and a 75% saving on current due-diligence costs.

Remember the good old days when your local banker knew everyone in the neighborhood and deals were sealed with a handshake? For better or worse, those days have been relegated to old movies and memories. Today’s bankers have a host of concerns, including major security and compliance issues.

One of the most significant US regulations with which bankers must comply is the Bank Secrecy Act (BSA). Passed in 1970 and amended several times since, the BSA requires financial institutions to help government agencies detect and prevent money laundering through an often arduous process.

This major US bank was dedicating a significant amount of time to mundane, repetitive, and manual data-gathering tasks necessary for anti-money-laundering (AML) and know-your-customer (KYC) compliance. Error-prone, inconsistent manual checks were taking time and energy away from higher value strategic activities, creating multiple backlogs, and were adversely affecting the bank’s compliance standards. So the bank set out to determine how to create additional capacity and eliminate errors while improving regulatory compliance.

Challenge

Keep pace with workload without adding personnel

The bank’s leadership saw that AML analysts were spending large amounts of time on routine, tedious tasks for due diligence processes. Although their talents could be better applied in more strategic analysis and investigations, they were consigned by regulatory necessity to perform due diligence and conduct manual data collection. Processes were inefficient and backlogs increasing, but the bank did not have the capacity to add more personnel. The bank also did not believe that a totally automated process could address the more complex tasks required by these investigations.

Solution

Build on an established relationship

Genpact already had a six-year strategic partnership with the bank, having helped it bring innovation to its customer service and integrate best-in-class security, risk, and compliance solutions.

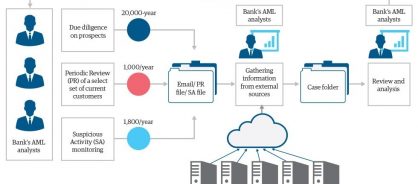

After gathering data and analyzing the scope of BSA activities, we determined that the bank handled around 20,000 cases of due diligence on prospects per year, periodically reviewed about 1,000 selected customers, and annually monitored 1,800 cases of suspicious activity. While the higher-level analysis and decision-making activities would need to remain employee focused, many of the repetitive tasks could be handled through an automated process. We made it clear that automation would never replace human research and decision-making within the due diligence process; instead, it would augment the capacity for human analysts to focus on value-added activities.

We proposed and implemented RPA to automate the processes. This shifted employee focus onto high-value tasks and generated capacity without adding cost. We also integrated the automated processes into several external applications, such as a due diligence database, a screening solution, the Office of Foreign Assets Control website, and a search engine for better research and due diligence.

In addition, we created a transformation roadmap, which outlines goals for process transformation and optimization by:

- Employing natural language processing (NLP) and natural language generation (NLG) to summarize the information gathered

- Using intelligent automation to handle complex tasks that are best performed by a combination of human agent and digital assistant

- Creating a digital record of all activities undertaken Integrating operational data with its due diligence process and using machine learning to identify patterns

Figure 1: Robotic process automation to automate due diligence, periodic review, and suspicious activity monitoring

Impact

Improved compliance with more time for high-value tasks

RPA enabled the bank to automate information gathering for due diligence on prospects, run periodic reviews of high-risk customers, and investigate suspicious activity.

Over five years, the bank is expected to save 75% in costs, improve regulatory compliance, and enable investigators to shift their focus to higher value tasks and strategic activities. And persuaded by the success of automating due diligence processes for the BSA compliance, several other departments have come forward to embrace RPA and evaluate potential partnerships with Genpact.