Cora ARFlow

Collect payments faster, reduce credit risk, and make more accurate forecasts and decisions with our accounts receivable solution

Overview

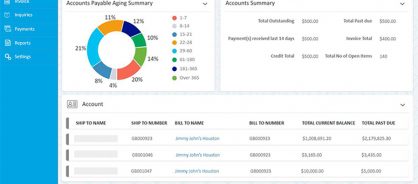

Cora ARFlow enhances collaboration across your accounts receivable process to boost cash flow and cut costs. It automates the end-to-end process from the time an order is placed until payment is received and cash is applied.

Increase cash flow

Our accounts receivable automation solution, built on Genpact Cora, helps your team focus on important, large, or long-overdue payments to reduce past-due receivables and bad debt reserves. It significantly cuts operational costs to maximize cash flow.

Optimize resources

We make accounts receivable management simple. We'll help you automate customer communications and provide greater visibility into disputes to resolve them faster. Our accounts receivable platform automates the process end to end, including documentation, and helps you optimize resources with the help of AI-enabled dynamic workflows.

Improve collections

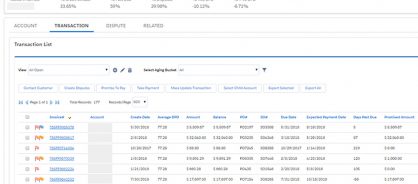

The alerts manager in ARFlow notifies you of changing credit exposure, portfolio performance, and customer payment behavior. The solution also helps you manage collection tasks in compliance with accounts receivable management policies, tracks user activity at every level (displaying it on user and management dashboards), and provides collections performance analysis.

Featured solutions

Credit risk management

Cora ARFlow automatically pulls data from credit bureaus and flags changes. This enables line-of-credit assessments, periodic reviews, and continual credit-threshold management to process orders.

Electronic invoice presentment and payment (EIPP)

Cora ARFlow uses EIPP to allow customers to instantly pay open invoices through multiple channels, such as e-invoicing and customer portals. It improves billing, collections, and cash management.

Collections management

The solution helps teams prioritize collections, automates customer communications, gives greater visibility into disputes, and measures performance and compliance against KPIs and policies.

Cash application management

CoraARFlow uses AI to automatically apply cash to invoices, resolve exceptions, provide suggestions for manual cash application for unmatched remittances, and increase revenue forecast accuracy.

Global support and scale

The platform supports multiple languages and currencies, with built-in disaster recovery. As a SaaS solution, it integrates, scales, and updates without compromising your existing IT infrastructure.

50%

reduction in past-due receivables

30%

cut in days sales outstanding

30%

decrease in dispute resolution time

Building superior experiences rooted in digital

A food services firm adopts Cora ARFlow for a more connected and customer-centric finance function.